One of the first questions that comes to mind for a person considering solar is: How much money will I save? While the question at hand might seem one dimensional, savings in owning a solar panel system goes far beyond reduced electricity bills. Today, we will be looking at how solar saves in three areas: electricity bills, tax credits, and the environment.

How much do solar panels save on electricity bills?

Much of the initial attraction of going solar is to reduce the cost of monthly electric and utility bills. But how much does solar actually save on these monthly bills? Well, a lot depends on how much photovoltaic (PV) energy your system is producing. The more your system produces the more you can save. Typically, a residential solar setup produces anywhere from 350-850 kWh per month. So with that in mind, the average home system uses approximately 909 kWh per month (according to U.S. Energy Information Administrations), meaning that owning solar can save you upwards of 90% on your monthly electric bills.

At Shop Renewable Energy, we work with premiere solar companies, who provide the best panels at the best price. We also verify that your roof is positioned well and free of shade to make sure that your panels will produce lots of electricity. If everything looks right, your solar system should save you hundreds a month, paying for your entire electric bill. The only fee that homeowners should be paying is the small monthly charge of about $10 to have your panels stay connected to the grid. All in all, it is our mission to help our customers save tens of thousands of dollars during their solar journey

How much do I save through tax incentives?

By owning your own solar system, you qualify for tax deductions from the government. Currently, in 2020, the government lets owners deduct 26% of the cost of installing a rooftop solar-electric generator, including the cost of any necessary remodeling or retrofitting work associated with the solar installation, from your federal income taxes. Thus, if you were to spend $10,000 dollars on your system, you will receive a $2,600 tax credit. As an added bonus, many states allow for households with solar units to also qualify for a deduction on their state income taxes as well.

Although solar does offer tax deductions, sometimes it can be daunting and confusing figuring out how to receive them. To make things simpler for our customers, we make it clear that all Shop Renewable Energy customers, who have a federal tax liability, qualify for the U.S. federal tax credit, and we provide a simple step-by-step guide to make receiving these savings easier than ever.

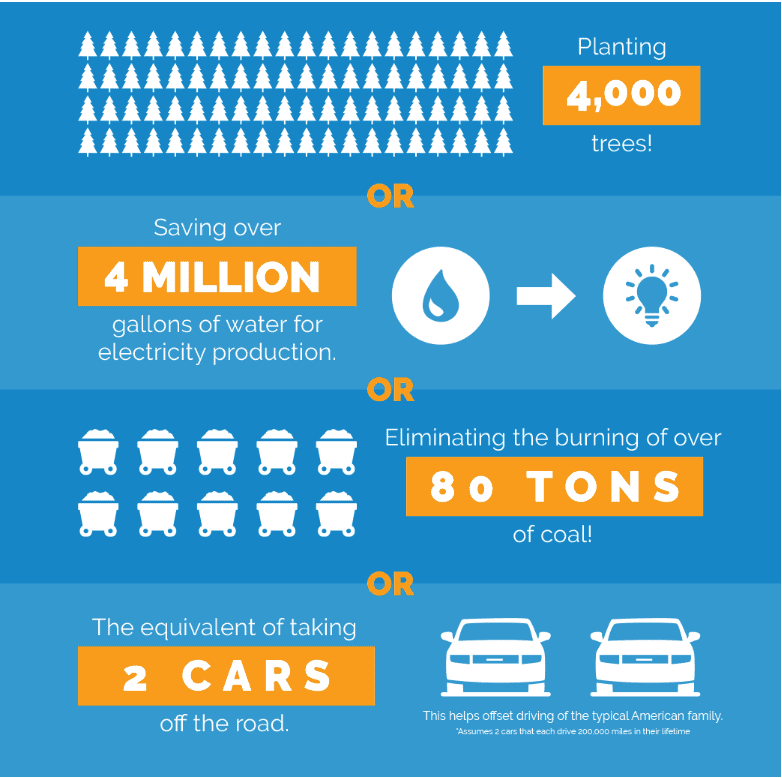

How much will my solar panels save the environment?

Another aspect to consider when you decide to go solar is the impact solar panels can make on the environment. The average residential solar system will offset energy produced by burning over 80 tons of coal or 175 tons of carbon dioxide in its lifetime. The energy generated is also equivalent to planting 4000 trees. So yes, solar panels make an impact and save our planet, and you can feel good knowing that you are making a difference.

So, what are the actual numbers?

Because there are a variety of factors to determine your savings, it’s hard to know how much money you’ll save exactly. Luckily, here at Shop Renewable Energy, we offer a free savings estimate. All you have to do is submit you name, email, phone number, and address, answer a few questions about your energy use, and our solar specialists will be able to give you an accurate, zero-commitment savings report. Get a Free Quote Today!

As you can see, you can access major savings by going solar. Whether it be saving on monthly bills, saving on reduced federal income taxes, or saving the environment, it is our hope that you become a part of the Blue Raven Solar community and start saving today!